As economic headlines shift week to week, Americans’ views on the economy tell a deeper story — one of caution, uncertainty, and adaptation.

The SSRS Economic Attitudes Tracker has been tracking this story as it develops since March 2025. Each wave captures how economic perceptions and inflation pressures are shaping Americans’ financial behavior, outlook, and trust in the country’s leadership.

The fourth wave was conducted in October 2025 and fielded using the SSRS Opinion Panel Omnibus, a nationally representative, probability-based survey of U.S. adults. This wave adds a new dimension: six in-depth, 30-minute follow-up interviews with survey respondents. These conversations go beyond the numbers, giving individuals a chance to describe their experiences in their own words, what they’re worried about, how they’re adapting, and where they still find hope.

Across this latest wave, several themes stand out:

- Economic optimism has started to fade as Americans once again grow more negative about the U.S. economy and job market.

- Cost of living remains a widespread and ever-present strain, with many saying they’re “doing everything right” financially but still can’t get ahead.

- Most Americans feel unseen and misunderstood by political leaders, viewing dysfunction in Washington as a reflection of a system that’s not working for them.

- People are adapting in quiet but significant ways: cutting back, reprioritizing, and searching for stability amid uncertainty.

Together, these findings reveal a country navigating an uneasy middle ground: hopeful for stability but increasingly doubtful that help is on the way.

Understanding these experiences isn’t just insightful, it’s essential. For policymakers, business leaders, and communicators, the Tracker provides actionable insight into what Americans are really thinking and feeling in today’s uncertain economy. It helps bridge the gap between statistics and sentiment, between what’s happening in the data and what’s happening in people’s lives.

The Return of Economic Pessimism

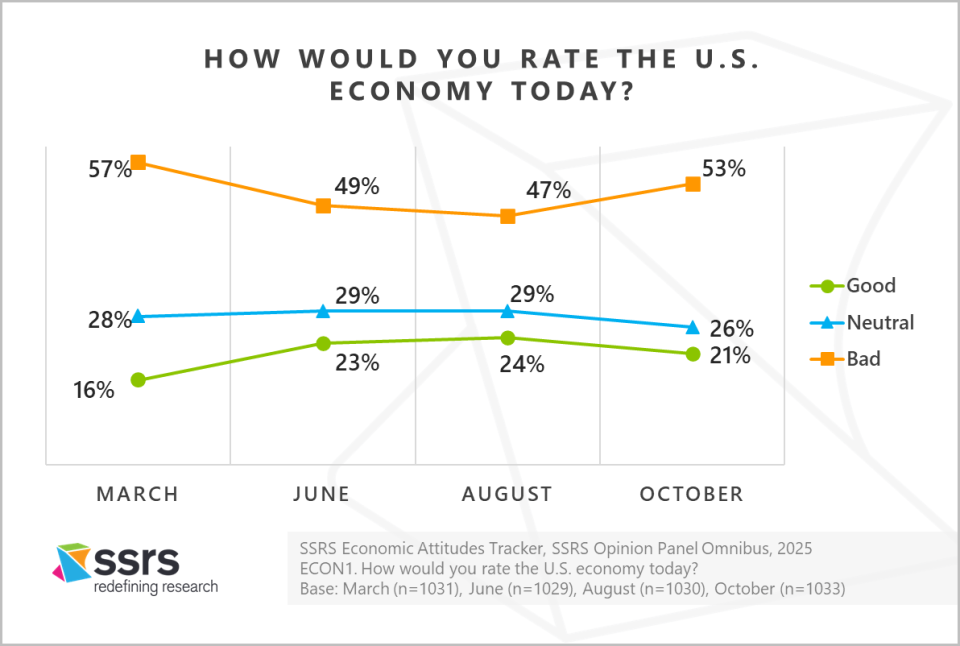

While the summer months—and delayed tariffs—may have brought some tempered optimism, the mood has started to shift as the days grow shorter. Americans are feeling more pessimistic about the state of the U.S. economy. After the share who rated the economy as bad fell from 57% in March to 47% in August, it has now climbed back up to 53% in October, a statistically significant increase over the previous wave.

Beneath the shifting numbers is an undercurrent of uncertainty and unease. Across the qualitative interviews, participants described an economy that feels unstable, confusing, and detached from their lived experiences. Many said their day-to-day realities don’t match the positive headlines they see—instead, prices continue to rise, wages remain stagnant, and political dysfunction rules the day. Together, these create the sense that things could easily unravel.

“I listen to a lot of news, and it’s kind of confusing because it sounds like it’s doing good. But in actuality, when I talk to a lot of people, it sounds like we’re moving in the wrong direction. So I’m kind of unsure about it… I would give a four. Because I don’t think, I don’t think we’re doing great.”

Even those who rated the economy as “average” or “holding steady” used words like fragile, artificial, and unpredictable. Together, these views reveal an American public that feels anxious and distrustful, uncertain whether the economy is truly positive or simply being “propped up.”

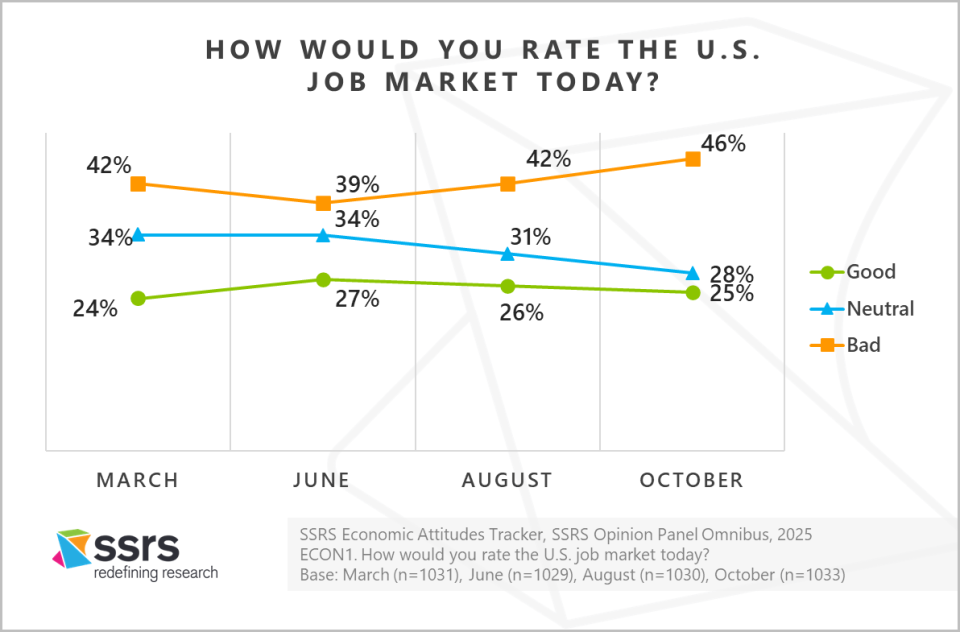

A Job Market that May Look Strong on Paper, but Feels Shaky in Reality

Americans are growing more pessimistic about the U.S. job market. The share rating it as “bad” has risen from 39% in June to 46% in October, marking a significant increase. At the same time, worry about the job market is climbing as well, rising from 61% in June to 66% in October who say they are very or moderately worried.

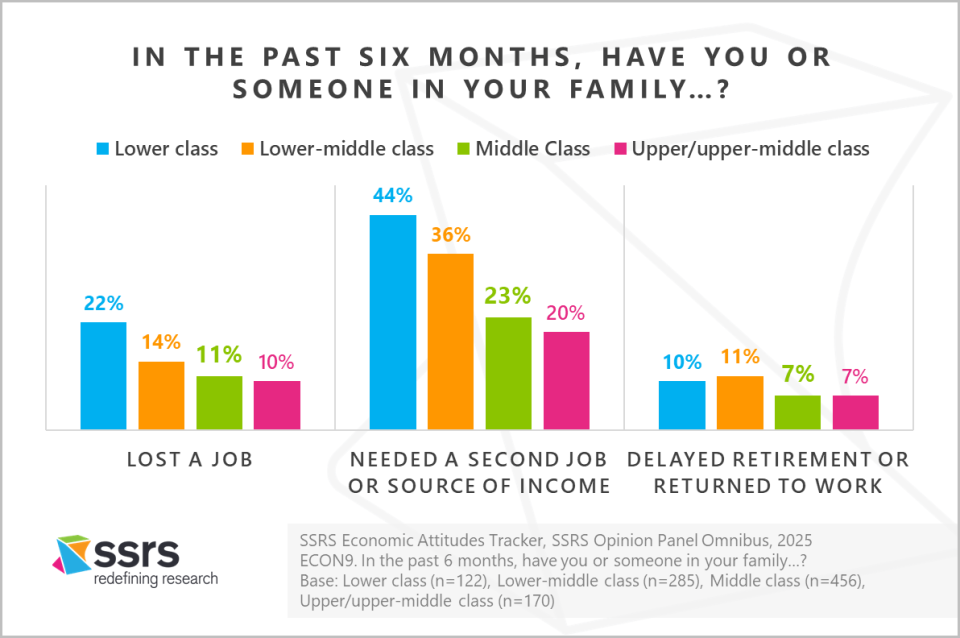

The challenging job market and economy are taking a tangible toll on American families. In the past six months:

- 29% say they or someone in their family needed a second job or source of income,

- 13% say they or a family member lost a job, and

- 9% say they or a family member delayed retirement or returned to work after retiring.

In follow-up interviews, participants described the difficulty of finding stable, good-paying work and the need for multiple jobs just to stay afloat. Some said older relatives were being “forced out of retirement,” while others lamented that “families shouldn’t have to have two or three jobs to get by.”

For one mother, the economic strain became personal when both of her adult children lost their jobs within months of each other. Her son, a long-time employee in technology, was laid off after 18 years and has struggled to find new work. Her daughter was laid off from a freight company that closed, and now depends on unemployment benefits. This mom has since taken on many of their expenses—tightening her own budget to help cover car payments, phone bills, and even pet care.

“Well, just to worry about people losing their jobs. Because if 30 people lost their job at my son’s work and 40 at my daughter’s, and I heard that Amazon’s letting go of I don’t know how many people. How many people are out there trying to get the same job?”

These experiences paint a picture of how job instability and the subsequent anxiety are affecting American households.

Struggles are Deepest for Working-class Americans

Economic strain is especially acute among those who self-identify as lower or lower-middle class. They or their families are more likely to report job loss or the need for a second income than middle-class or upper/upper-middle Americans.

These numbers reveal yet another disconnect between positive jobs headlines and what people are experiencing in reality

“Doing Everything Right” Just Isn’t Enough

Six in ten Americans (58%) say they feel like they’re doing everything right financially but still can’t get ahead. Participants described paying bills on time, budgeting carefully, and cutting back where they can—yet feeling no closer to stability. Rising costs for essentials like rent, utilities, and groceries continue to outpace progress and reinforce a sense of personal financial stagnation.

“It just seems like everything costs so much now that when you think you have a hold on it, something else happens. Like this morning, my son came from work and his car, we’re either going to junk it or we’re going to have to invest in another car, which was kind of unexpected. So it’s just those things that you’re not planning for that just kind of pop up. There’s always something.”

Cost of Living Pressures Remain Entrenched

The cost of living remains a persistent and universal concern for Americans, reinforcing the sense of economic unease that has lingered throughout 2025. About three in four Americans are very or moderately worried about cost of living — a figure that has held steady across all waves of the Economic Attitudes Tracker.

Inflation Touches Every Corner of Daily Life

In the August wave of the Economic Attitudes Tracker, most Americans reported noticing price hikes across all essential categories, including groceries (85%), housing (79%), utilities (78%), insurance (77%), diapers (76%), pet ownership (69%), and healthcare (65%) and prescription medications (51%) over the preceding three months.

“Inflation is bad. Just everything. I just made an order for our groceries and Halloween candy, which you do every year. It was $20 and I’m like $20 for a bag of candy! It wasn’t anything special. Little things like that, gas prices…everything seems higher now than it ever was in what I remember in my lifetime.”

These stories illustrate how inflation continues to shape daily life, embedded in virtually all everyday expenses that once might have gone unnoticed.

Americans Continue to Adjust and Cut Back

A striking 87% of Americans say they have taken action to save money in the past three months — a consistent signal of ongoing financial strain and cautious consumer behavior.

- More households are tightening their grocery budgets: 57% are changing what groceries they buy in order to stay within budget in October, compared to 53% in August and 52% in June.

- Discretionary spending continues to shrink: 55% are cutting back on extras and entertainment to afford necessities, compared to 51% in August and 49% in June.

- Dining out is increasingly off the table: 55% are going to bars and restaurants less frequently in October, up from 51% in August and 49% in June.

Americans are also making broader lifestyle adjustments to cope with ongoing financial strain. About two in five avoided buying imported products due to higher prices (44%), traveled less than usual (42%), delayed a home or car repair (42%), or say they’ve driven less to save on gas (40%) in the past three months.

The tradeoffs go even deeper for many households: three in ten have postponed or canceled healthcare appointments (28%), one in five have moved or considered moving to lower their housing costs (22%), and one in seven have skipped or stretched prescription medications to make them last longer (14%) in the past three months.

While these shifts have been incremental, the pattern is clear: Americans are still in belt-tightening mode, finding new ways to adapt to high costs that show few signs of easing.

Americans are Struggling to Look Ahead

For many Americans, economic uncertainty has become an enduring reality. Three in four (75%) say that uncertainty now feels like the “new normal,” and a similar share (72%) report that it’s difficult to make long-term financial plans when the economy feels so unpredictable.

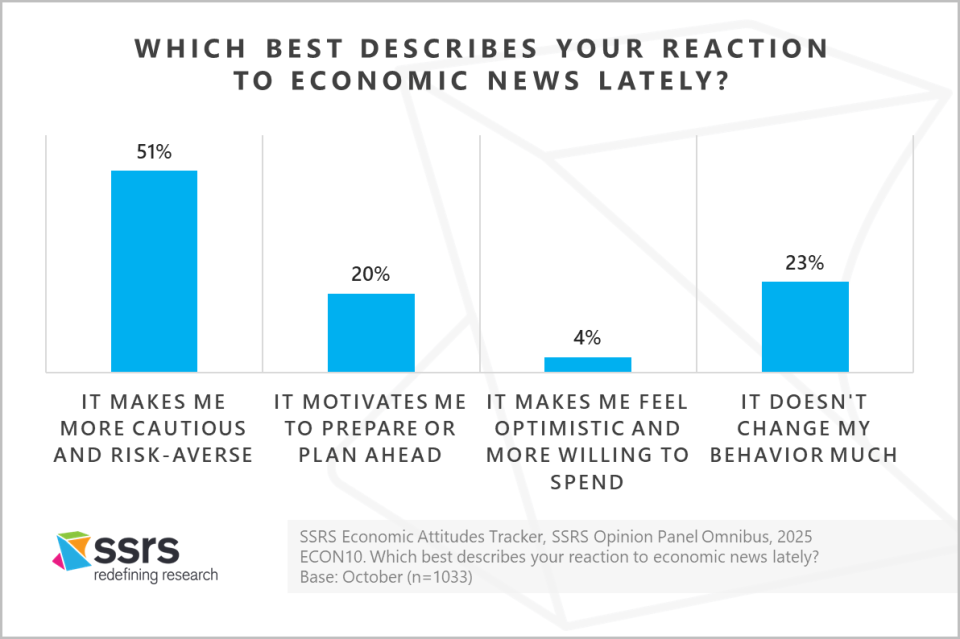

Recent news about the economy often reinforces this sense of caution and paralysis. Half (51%) say it makes them more risk-averse—hesitant to take financial chances or make big purchases for fear of losing more than they can afford. In contrast, one in five (20%) say economic news motivates them to plan ahead, building budgets or safety nets to prepare for what’s next. About one in four (23%) say they remain largely unaffected by economic headlines.

Americans Feel Unseen and Misunderstood in Their Economic Struggle

Eight in ten (79%) agree that “politicians don’t understand the economic reality I am living in” with half of Americans (49%) saying strongly agree. This sentiment cuts across every demographic group—showing that frustration with political leaders is both widespread and deeply felt.

- By generation: From young to old, the sense of disconnect is nearly universal (73% Gen Z, 80% Millennial, 82% Gen X, 77% Baby Boomer).

- By economic class: Those in every self-reported class feel unheard (82% lower class, 79% lower-middle class, 78% middle class, 79% upper/upper-middle class).

- By race: Perceptions are consistent across racial groups (81% White, 73% Black, 79% Hispanic, 64% Other).

- By political affiliation: While Republicans are somewhat less likely to agree, a strong majority across the political spectrum share this view (87% Democrats, 82% Independents, 69% Republicans).

One survey respondent summed up the widely perceived disconnect between politicians and the public this way,

“Their salaries are much larger than the little people out here. I don’t see how they could honestly understand our reality when that is not their lifestyle or their worries. They don’t have the same worries as the small working class. I wish that they would live six months in our shoes with having to live paycheck to paycheck and really having to watch their money and their budget and see how then they could really get a feel of what most people go through.”

Political Dysfunction Deepens Economic Anxiety

In follow-up interviews, participants described growing distrust toward leaders they see as detached from everyday life. Many said the system “works for the powerful,” while ordinary families fall further behind.

“If one day they were without a warm meal, without warm water, without even light, they would definitely understand what it is that they should be doing when they’re talking to us people to vote for them.”

The recent government shutdown has amplified that frustration. For many, it wasn’t viewed as a political issue at all, but as another sign that “things aren’t working.” Even those not directly affected expressed concern about ripple effects — from unpaid workers to halted benefits — seeing it as more proof of a system in disarray.

“They can’t get along. To a point where it’s hard to place any trust in them. That respect has been lost. So, so much infighting that I’ve lost confidence. And I wonder, is there anybody who can come in there? A person who, or people who, put the people’s interest first?”

What Americans Want to See Change

While rising prices and inflation remain the dominant economic concern, Americans also point to global instability (13%), political gridlock (11%), and the national debt (9%) as key issues.

When asked what would signal that the U.S. economy is improving, people cited both economic and political changes:

- Falling inflation rates (49%)

- Lower housing costs (46%)

- Resolution to the government shutdown (43%)

- Political cooperation or stability in Washington (42%)

- Lower interest rates (38%)

- Improvements in global stability (38%)

- Stronger job growth (37%)

- Declining consumer debt levels (27%)

- Stock market gains (21%)

Americans want to see progress not just in prices, but in leadership — tangible signs that both the economy and the government are finally working for ordinary people again.

One respondent captured the sentiment vividly:

“Oh boy — less fighting in government leadership that you could actually put your trust in. There’s too much division on both sides, and it’s gotten so out of control that it’s hard to take it seriously anymore. Act like leaders — earn it. Stop demonizing people. Respect has been lost. And if we don’t stop fighting each other, there may not be a country left to fight over.”

Conclusion

This wave of the SSRS Economic Attitudes Tracker underscores a critical truth: perception drives behavior. As Americans confront rising costs and political dysfunction, their attitudes toward the economy are shaping spending, saving, and confidence in powerful ways. For decision-makers, understanding this mindset is key—not just to interpreting the current moment, but to anticipating what comes next.

Join Our Economic Trends Mailing List

Methodology

The Economic Attitudes Tracker is conducted by SSRS on its Opinion Panel Omnibus platform. The SSRS Opinion Panel Omnibus is a national, twice-per-month, probability-based survey.

Economic Attitudes Tracker waves include:

- March 21 – March 24, 2025 among a sample of 1,031 panelists. The survey was conducted via web (n=1,001) and telephone (n=30) and administered in English (n=1,005) and Spanish (n=26). The margin of error for total respondents is +/-3.8 percentage points at the 95% confidence level. The design effect is 1.54.

- June 6 – June 10, 2025 among a sample of 1,029 respondents. The survey was conducted via web (n=999) and telephone (n=30) and administered in English (n=1,004) and Spanish (n=25). The margin of error for total respondents is +/-3.5 percentage points at the 95% confidence level. The design effect is 1.29.

- August 1 – August 4, 2025 among a sample of 1,030 respondents. The survey was conducted via web (n=1,000) and telephone (n=30) and administered in English (n=1,004) and Spanish (n=26). The margin of error for total respondents is +/-3.5 percentage points at the 95% confidence level. The total sample design effect for this survey is 1.31.

- October 16 – October 19, 2025 among a sample of 1,033 respondents. The survey was conducted via web (n=1,003) and telephone (n=30) and administered in English (n=1,007) and Spanish (n=26). The margin of error for total respondents is +/-3.5 percentage points at the 95% confidence level. The total sample design effect for this survey is 1.34. SSRS recontacted five respondents from the Omnibus survey to invite them to participate in a qualitative in-depth follow-up interview. Each interview lasted 30-minutes and was conducted over Zoom with an SSRS researcher between October 28 – 30, 2025.

All SSRS Opinion Panel Omnibus data are weighted to represent the target population of U.S. adults ages 18 or older.

The SSRS Opinion Panel Omnibus is conducted on the SSRS Opinion Panel. SSRS Opinion Panel members are recruited randomly based primarily on nationally representative ABS (Address Based Sample) design (including Hawaii and Alaska). ABS respondents are randomly sampled by Marketing Systems Group (MSG) through the U.S. Postal Service’s Computerized Delivery Sequence File (CDS), a regularly updated listing of all known addresses in the U.S. For the SSRS Opinion Panel, known business addresses are excluded from the sample frame. Additional panelists are recruited via random digit dial (RDD) telephone sample of cell phone numbers connected to a prepaid cell phone. This sample is selected by MSG from the cell phone RDD frame using a flag that identifies prepaid numbers. Prepaid cell numbers are associated with cell phones that are “pay as you go” and do not require a contract.

The SSRS Opinion Panel is a multi-mode panel (web and phone). Most panelists take self-administered web surveys; however, the option to take surveys conducted by a live telephone interviewer is available to those who do not use the internet as well as those who use the internet but are reluctant to take surveys online.