As volatile markets, tariff tensions, and a ballooning national debt unsettle the U.S. economy, many households are continuing to feel the squeeze in the grocery aisle, in utility bills, and in monthly rent checks.

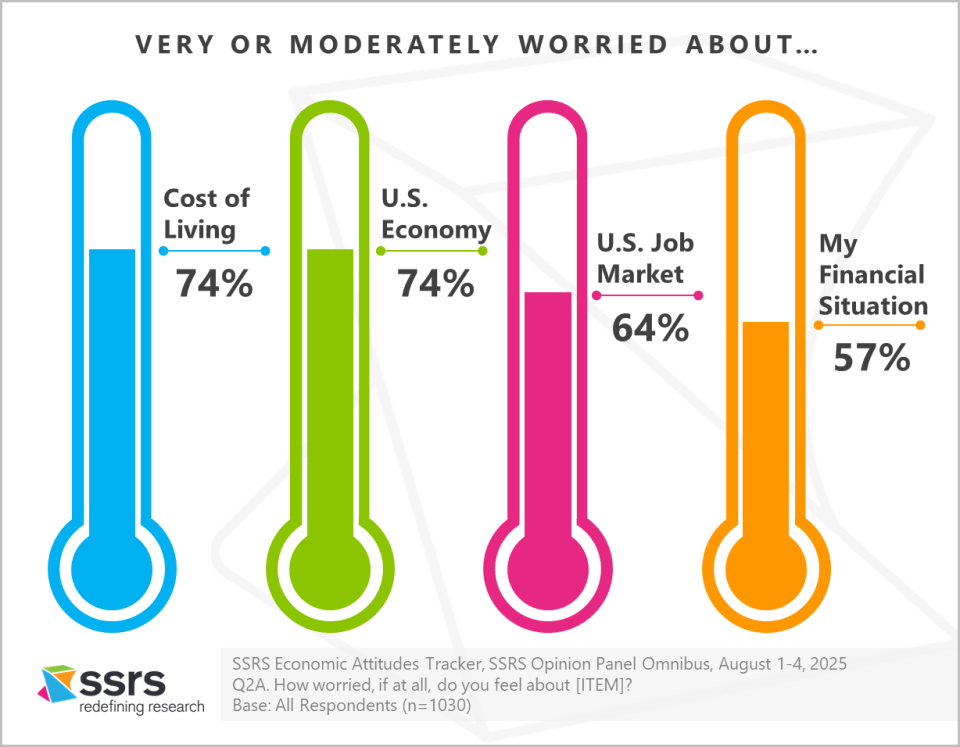

The result? Nearly three in four Americans are still worried about the cost of living and the broader economy, according to the August 2025 Wave of the SSRS Economic Attitudes Tracker.

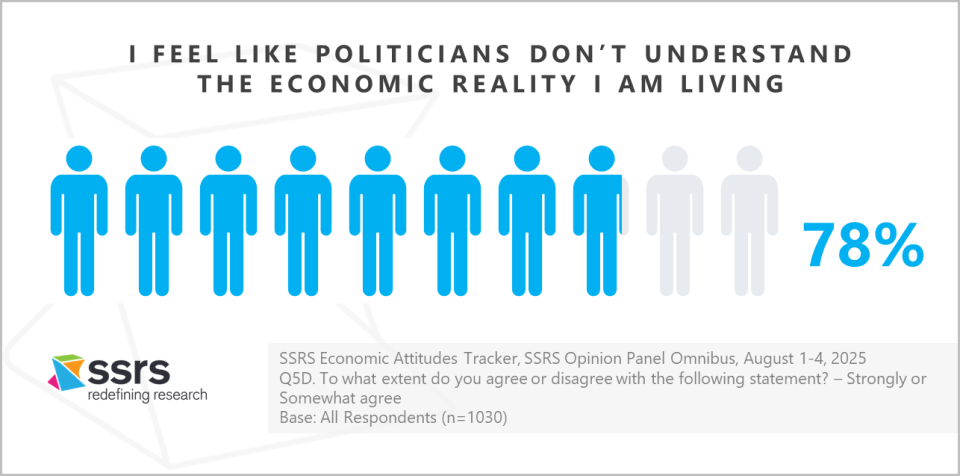

Moreover, anxiety doesn’t stop at household budgets – it’s bleeding into major life decisions. More than half of Americans believe now is not a good time to buy a car, start a business, or even have a child. And public confidence in our leaders’ ability to stave off economic concerns is thin. Eight in ten Americans believe politicians don’t understand the economic reality they’re facing. That disconnect raises doubts about whether meaningful relief is coming anytime soon.

Our research shows how Americans are adapting: cutting back on essentials, reshaping spending, and postponing major choices. The findings paint a picture of an anxious, but adaptive, nation.

Americans’ State of Mind

Nearly three-quarters of Americans are worried about both the cost of living (74%) and the U.S. economy (74%)—levels of anxiety that have held steady since March. Anxiety around the job market has ticked upward, rising to 64% very or moderately worried in August, up from 61% in June.

When it comes to personal finances, worry has been steady since the first wave of the SSRS Tracker in March. About 57% are worried about their financial situation, and 55% about their ability to find a new job if they needed to.

While Americans express strong concerns about the job market overall, they are less worried about their own situations: 35% are worried about their job stability and 33% about their employment situation, both unchanged since March (36% and 34%, respectively). Looking specifically at those working full- or part-time, concern levels are only slightly higher, with 38% worried about job stability and 35% about their employment situation

This concern is reflected in Americans’ perceptions of political leadership. Eight in ten Americans (78%) agree that politicians don’t understand the economic reality they are living in. The widespread perception of disconnected politicians can only undermine public trust that relief is on the way.

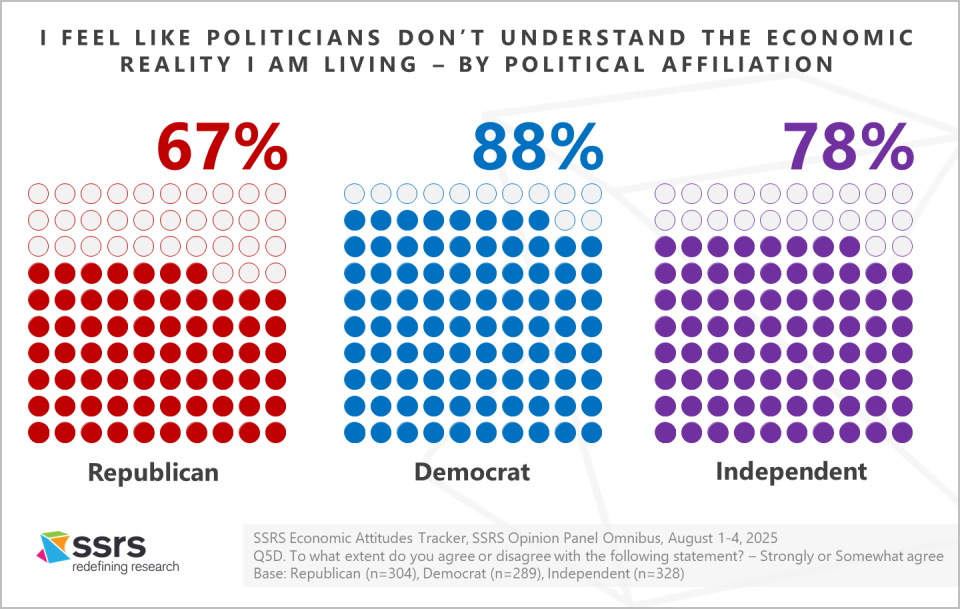

The perceived disconnect is not partisan. Although Republicans are somewhat less likely than Democrats to feel overlooked—67% versus 88%—a clear majority of both parties agree that politicians don’t grasp the economic realities they face.

Cost of Living Remains a Point of Concern

Cost of living continues to be one of the most pressing concerns for Americans. Nearly three-quarters (74%) say they are worried about it, and more than half (56%) believe their income has not kept pace with rising expenses. For over one in three (36%), this worry is intense—they report being very worried about cost of living.

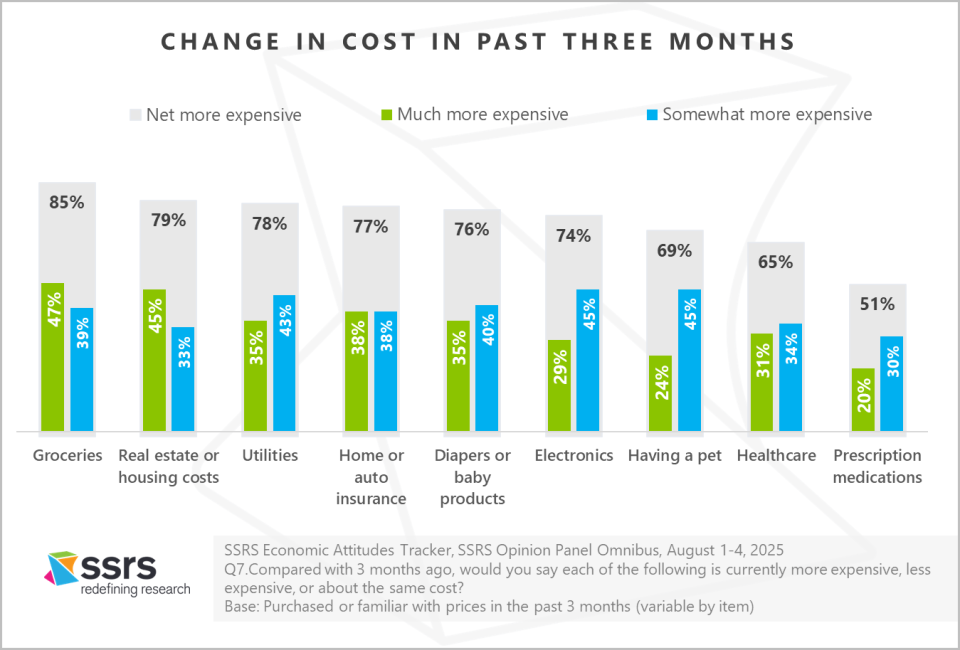

The sense of strain is grounded in daily realities. Americans are seeing price hikes across essential categories:

- Groceries top the list, with 85% reporting they have become more expensive in just the past three months, including about half who say they are much more expensive.

- Housing (79%), utilities (78%), and home and auto insurance (77%) follow closely, underscoring how broadly inflationary pressures are felt.

Faced with these increases, many are adjusting their behavior to cope. Nearly two-thirds (62%) are trying to reduce their utility bills, more than half (53%) are changing the types of groceries they buy, and about half are cutting back on discretionary purchases—everything from entertainment to everyday “extras.”

Changes in consumer spending behaviors will be felt across industries, from retail and restaurants to housing and insurance markets. For policymakers, these findings underscore persistent public unease about inflation. In the eyes of consumers, everyday prices remain the truest measure of economic health.

Americans are Hesitant to Make Major Life Decisions

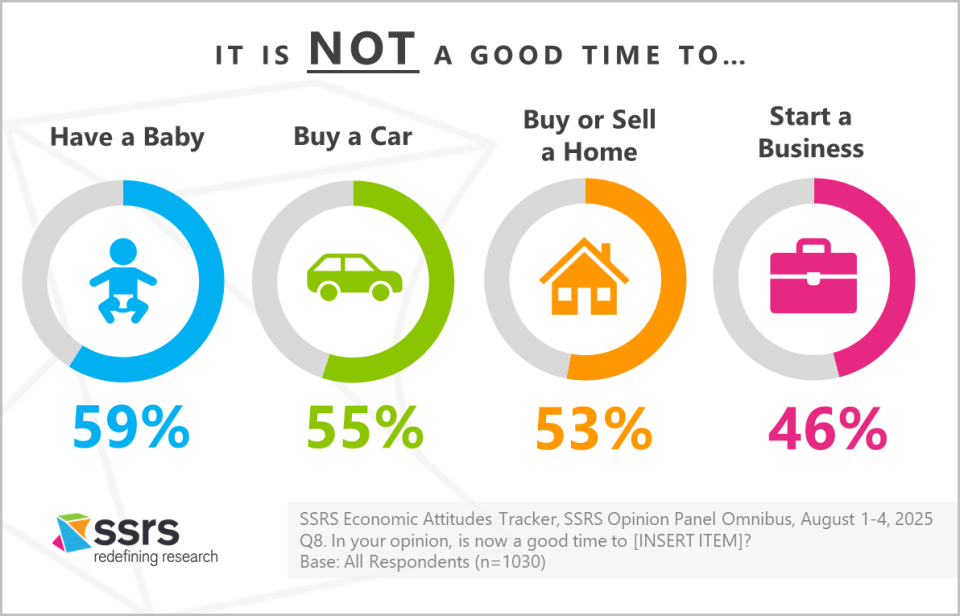

High levels of economic anxiety are shaping behavior across the board. Americans are not just actively adjusting their spending; they are postponing large purchases and even delaying major life decisions. When asked generally whether now is a good time to take significant steps, like buying a car, starting a business, or having a child, many are hesitant.

In fact, Americans are at least three times more likely to say it is not a good time have a child, buy a car, or buy or sell a home than to say it is, signaling widespread caution.

Investment decisions are more evenly split. Thirty-one percent of Americans believe now is a good time to invest in the stock market, 35% say it is not, and another 34% are uncertain.

Conclusion

The August 2025 SSRS Economic Attitudes Tracker shows how deeply economic pressures are shaping both daily trade-offs and long-term decisions. These shifts can’t be understood through market indicators alone—policymakers need to look closely at the public’s lived experiences. Tracking these attitudes is essential for anticipating change, identifying risks, and seizing opportunities in a climate where uncertainty is the new normal.

Want more insight?

Read the accompanying blog post from SSRS VP Jenny Berg, focusing on Gen Z and the economy >>

View the questions used for this analysis, along with the responses (topline) >>

Methodology

The Economic Attitudes Tracker is conducted by SSRS on its Opinion Panel Omnibus platform. The SSRS Opinion Panel Omnibus is a national, twice-per-month, probability-based survey.

Economic Attitudes Tracker waves include:

- March 21 – March 24, 2025, among a sample of 1,031 panelists. The survey was conducted via web (n=1,001) and telephone (n=30) and administered in English (n=1,005) and Spanish (n=26). The margin of error for total respondents is +/-3.8 percentage points at the 95% confidence level. The design effect is 1.54.

- June 6 – June 10, 2025, among a sample of 1,029 respondents. The survey was conducted via web (n=999) and telephone (n=30) and administered in English (n=1,004) and Spanish (n=25). The margin of error for total respondents is +/-3.5 percentage points at the 95% confidence level. The design effect is 1.29.

- August 1 – August 4, 2025, among a sample of 1,030 respondents. The survey was conducted via web (n=1,000) and telephone (n=30) and administered in English (n=1,004) and Spanish (n=26). The margin of error for total respondents is +/-3.5 percentage points at the 95% confidence level. The total sample design effect for this survey is 1.31.

All SSRS Opinion Panel Omnibus data are weighted to represent the target population of U.S. adults ages 18 or older.

The SSRS Opinion Panel Omnibus is conducted on the SSRS Opinion Panel. SSRS Opinion Panel members are recruited randomly based primarily on nationally representative ABS (Address Based Sample) design (including Hawaii and Alaska). ABS respondents are randomly sampled by Marketing Systems Group (MSG) through the U.S. Postal Service’s Computerized Delivery Sequence File (CDS), a regularly updated listing of all known addresses in the U.S. For the SSRS Opinion Panel, known business addresses are excluded from the sample frame. Additional panelists are recruited via random digit dial (RDD) telephone sample of cell phone numbers connected to a prepaid cell phone. This sample is selected by MSG from the cell phone RDD frame using a flag that identifies prepaid numbers. Prepaid cell numbers are associated with cell phones that are “pay as you go” and do not require a contract.

The SSRS Opinion Panel is a multi-mode panel (web and phone). Most panelists take self-administered web surveys; however, the option to take surveys conducted by a live telephone interviewer is available to those who do not use the internet as well as those who use the internet but are reluctant to take surveys online.