Gen Z is sounding the alarm.

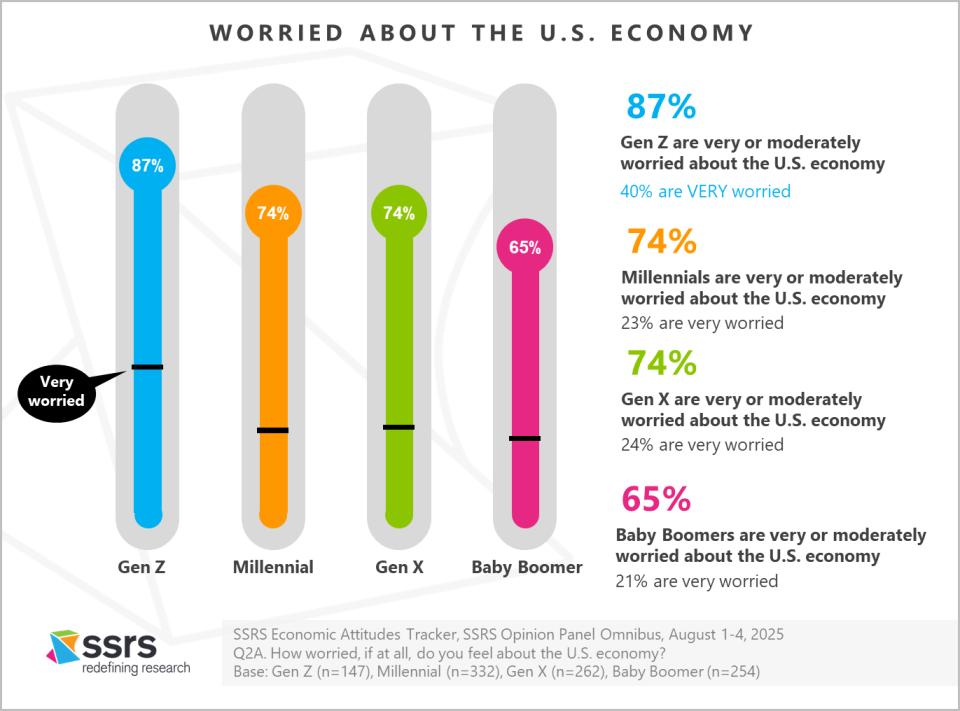

While every generation is feeling the squeeze of inflation, job insecurity, and rising costs, no group is more unsettled than the youngest adults. Far from being defined by optimism, Gen Z, born between 1997 and 2007, is entering adulthood with a sense of caution, skepticism, and strain.

The SSRS Economic Attitudes Tracker reveals just how sharply Gen Z stands apart: they are the most likely to call the economy “bad,” the most worried about job stability, and the most financially strained. But this isn’t just youthful pessimism. These are the workers, consumers, and household-builders who will shape the next several decades of American economic life.

What Gen Z is telling us today isn’t just about their own reality—it’s a red flag for America’s economic future.

Gen Z’s Reality: Job insecurity and rising costs

Gen Z stands out as the generation most uneasy about today’s economy and job market. Six in ten (60%) rate the U.S. economy as bad, and an overwhelming 87% say they are worried about it.

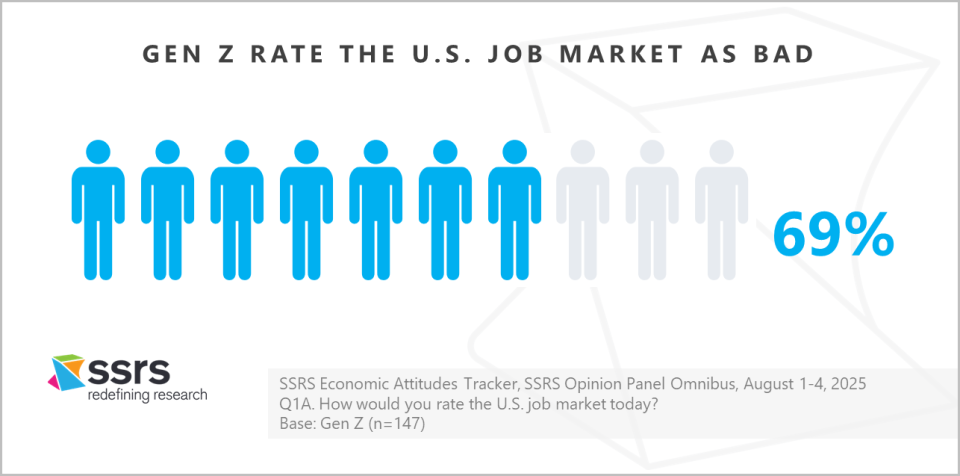

But the job market looms even larger in their concerns. Seven in ten Gen Zers (69%) describe it as bad, with one in three (32%) going so far as to call it very bad.

This outlook is reflected in how they view their own employment. Only two in five Gen Zers (42%) rate their current work situation as good—well below Millennials (63%) and Gen Xers (61%). In fact, one in four (25%) say their employment situation is bad, revealing a notable gap in satisfaction compared to older generations.

Job instability is another major source of stress for Gen Z. They are the generation most likely to have been directly affected by recent layoffs: one in five (19%) report that they or someone in their household has lost a job in the past three months. That compares with 14% of Millennials, 12% of Gen X, and just 7% of Baby Boomers. The lower rate among Baby Boomers may be due in part to retirement, which could make them less vulnerable to the disruptions of today’s job market.

Not surprisingly, half of Gen Z report being worried about their job stability, and nearly eight in ten (79%) are worried about their ability to find a new job if they needed one. This may leave many feeling stuck—working in roles that are either unsatisfying or financially insufficient, but too risky to leave.

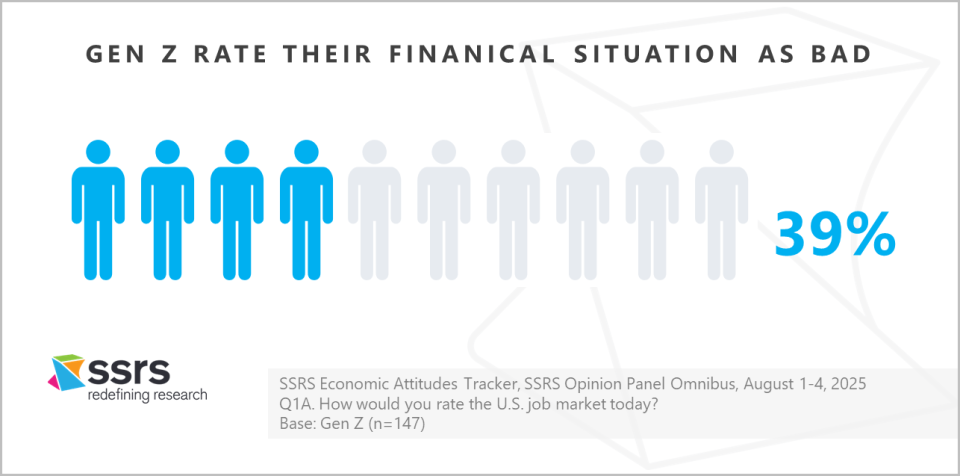

Their financial outlook tells a similar story of strain. Gen Zers are nearly twice as likely to describe their financial situation as bad (39%) as good (21%). By contrast, every other generation reports more positive than negative assessments of their finances: Millennials (40% good vs. 28% bad), Gen X (46% good vs. 28% bad), and Baby Boomers (64% good vs. 14% bad).

Why It Matters

Gen Z’s attitudes are more than just a snapshot of youthful pessimism—they are a window into the future. This is the generation entering the workforce, forming households, and shaping consumer markets. Their heightened financial anxiety and skepticism about job stability can affect everything from how they spend to how long they stay with an employer.

For businesses, this suggests challenges and opportunities: companies may need to adapt by offering clearer career pathways, more flexible benefits, and pricing strategies that acknowledge Gen Z’s budget constraints. For policymakers, these concerns foreshadow potential shifts in priorities around jobs, housing affordability, and economic stability.

In short, Gen Z’s economic outlook today could be a leading indicator of broader social and market trends tomorrow.

Gen Z is making the biggest sacrifices

No generation is feeling the squeeze of today’s economy more acutely than Gen Z. To make ends meet, they are cutting deeper and adjusting faster than their older counterparts—and the sacrifices they report point to both immediate trade-offs and long-term consequences.

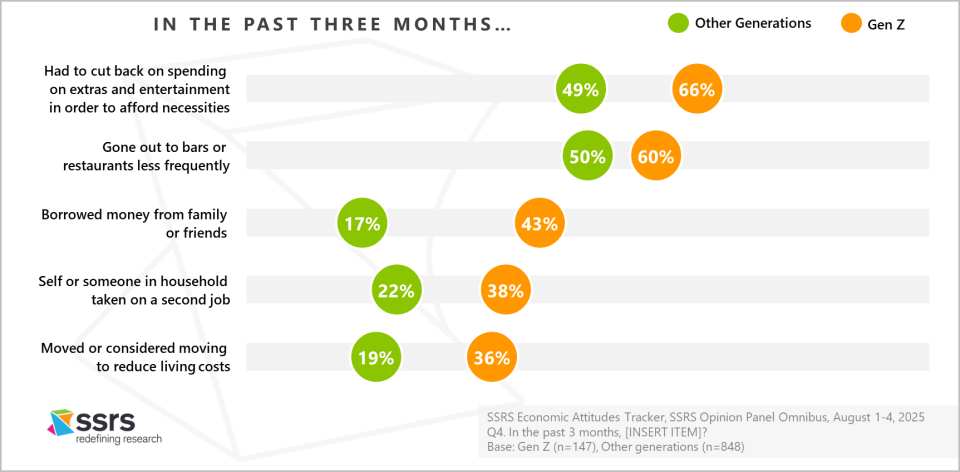

Two-thirds of Gen Z (66%) say they have cut back on “extras” like entertainment in order to afford basic necessities, compared to just half of those in the older generations (49%). Nights out are also being scaled back: six in ten Gen Zers (60%) are going to bars and restaurants less frequently, reshaping not just their social lives but the industries that rely on their spending.

For many, the trade-offs hit closer to home. Nearly half (46%) of Gen Zers have delayed a home or car repair, decisions that may save money in the short term but risk larger costs down the line. Another 45% say they have avoided imported products because of higher prices, reflecting both heightened price sensitivity and shifting consumer choices in global markets.

The financial strain is also visible in how Gen Z manages cash flow. More than four in ten (43%) have borrowed money from family or friends in the past three months—more than double the rate of older generations (17%)—suggesting that informal safety nets are becoming critical to staying afloat. Others are working more: 38% say they or someone in their household has taken on a second job or source of income.

Perhaps most telling, over one in three Gen Zers (36%) report they have moved or considered moving to lower their living costs. This willingness to uproot underscores just how deeply economic pressures are influencing not only spending habits but also major life decisions.

Taken together, these patterns reveal a generation that is not just adjusting discretionary spending but rethinking how they live, work, and spend. For businesses and policymakers, this signals both vulnerability and resilience: Gen Z is adapting quickly, but the depth of their sacrifices may carry ripple effects across industries, communities, and the broader economy.

Economic uncertainty threatens generational futures

Younger Americans are particularly cautious about making major life moves.

Having a child

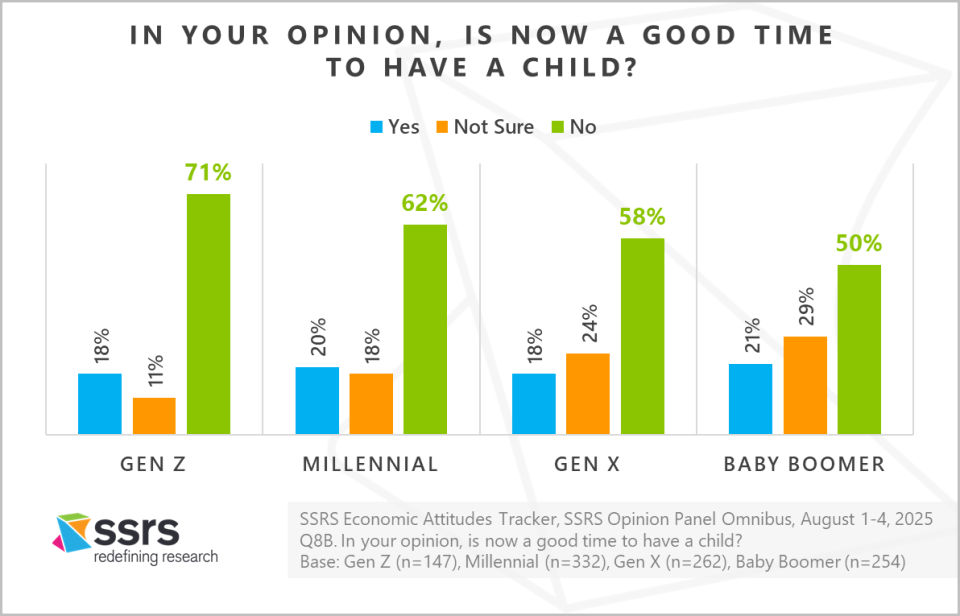

Choosing to start a family is a huge life decision influenced by financial and social conditions. When asked generally rather than personally about having a child, 71% of Gen Z and 62% of Millennials say now is not a good time to have a child, compared to 58% of Gen X and 50% of Baby Boomers. Notably, one in five across generations believes it is a good time, but Baby Boomers and Gen X are more likely to say they are not sure if now is a good time to have a child (24% and 29%, respectively).

Buying or selling a home

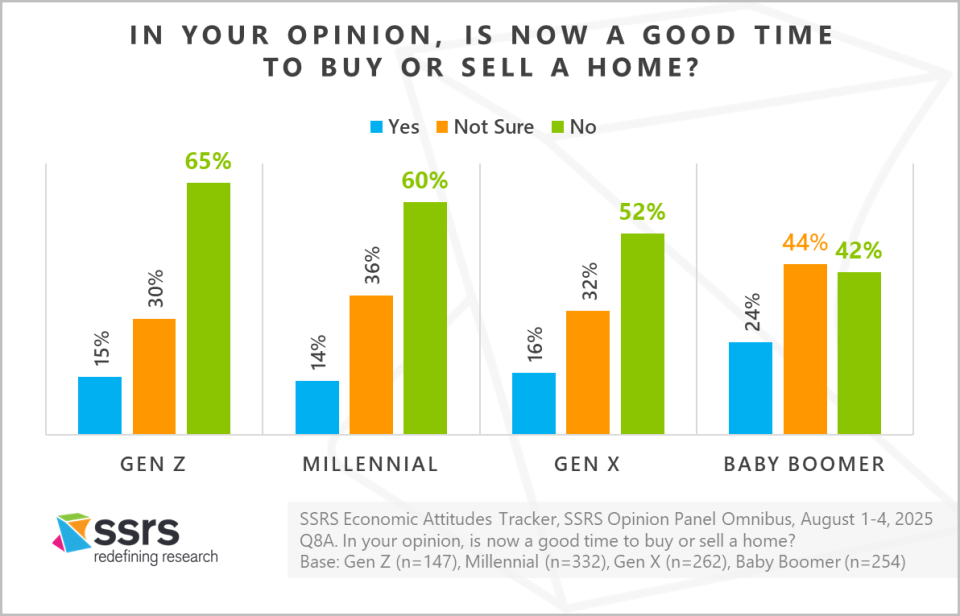

Homeownership is both a financial commitment and a life milestone. Sixty-five percent of Gen Z, 60% of Millennials, and 52% of Gen X say now is not a good time to buy or sell a home in general, compared with 42% of Baby Boomers. Baby Boomers are also the most likely to see the current moment as favorable: about one in four say it is a good time to buy a home (24%), versus 15% of Gen Z, 14% of Millennials, and 16% of Gen X.

Starting a Business

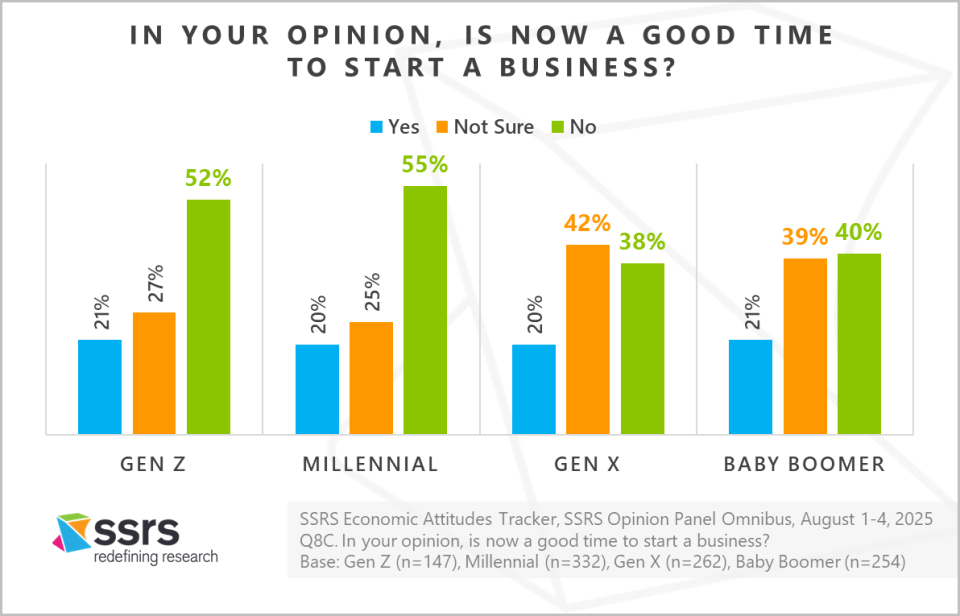

Entrepreneurship is inherently risky, and younger generations are skeptical about whether now is the right time. Fifty-five percent of Millennials and 52% of Gen Z say it is not a good time to start a business. Gen X (42%) and Baby Boomers (39%) are more likely than younger generations to respond with uncertainty, saying they are ‘not sure’ rather than an outright ‘no’.

These findings illustrate how economic uncertainty is shaping not just spending habits but life trajectories. Younger Americans are deferring major commitments—from children to homes to entrepreneurship—potentially influencing long-term demographic and economic trends.

Conclusion

Gen Z’s economic attitudes are not fixed—they’re evolving in real time alongside shifting job markets, rising costs, and broader economic uncertainty. Today’s worries may deepen, or they may give way to new priorities as conditions change. What is clear is that this generation is already making decisions—about work, spending, family, and mobility—that will reverberate across industries and communities.

For businesses, policymakers, and leaders, the message is clear: we can’t treat Gen Z’s outlook as a one-time snapshot. Their perceptions are a leading indicator of where markets and society are heading, but only if we keep our finger on the pulse. Continuous tracking of their attitudes will be essential to anticipating challenges, spotting opportunities, and understanding how America’s economic future is being rewritten—one generation at a time.

View the questions used for this analysis, along with the responses (topline) >>

Read the SSRS report, “Americans Anxious about Economy Amid Rising Cost of Living” >>

Methodology

The Economic Attitudes Tracker is conducted by SSRS on its Opinion Panel Omnibus platform. The SSRS Opinion Panel Omnibus is a national, twice-per-month, probability-based survey.

Economic Attitudes Tracker waves include:

- March 21 – March 24, 2025 among a sample of 1,031 panelists. The survey was conducted via web (n=1,001) and telephone (n=30) and administered in English (n=1,005) and Spanish (n=26). The margin of error for total respondents is +/-3.8 percentage points at the 95% confidence level. The design effect is 1.54.

- June 6 – June 10, 2025 among a sample of 1,029 respondents. The survey was conducted via web (n=999) and telephone (n=30) and administered in English (n=1,004) and Spanish (n=25). The margin of error for total respondents is +/-3.5 percentage points at the 95% confidence level. The design effect is 1.29.

- August 1 – August 4, 2025 among a sample of 1,030 respondents. The survey was conducted via web (n=1,000) and telephone (n=30) and administered in English (n=1,004) and Spanish (n=26). The margin of error for total respondents is +/-3.5 percentage points at the 95% confidence level. The total sample design effect for this survey is 1.31.

All SSRS Opinion Panel Omnibus data are weighted to represent the target population of U.S. adults ages 18 or older.

The SSRS Opinion Panel Omnibus is conducted on the SSRS Opinion Panel. SSRS Opinion Panel members are recruited randomly based primarily on nationally representative ABS (Address Based Sample) design (including Hawaii and Alaska). ABS respondents are randomly sampled by Marketing Systems Group (MSG) through the U.S. Postal Service’s Computerized Delivery Sequence File (CDS), a regularly updated listing of all known addresses in the U.S. For the SSRS Opinion Panel, known business addresses are excluded from the sample frame. Additional panelists are recruited via random digit dial (RDD) telephone sample of cell phone numbers connected to a prepaid cell phone. This sample is selected by MSG from the cell phone RDD frame using a flag that identifies prepaid numbers. Prepaid cell numbers are associated with cell phones that are “pay as you go” and do not require a contract.

The SSRS Opinion Panel is a multi-mode panel (web and phone). Most panelists take self-administered web surveys; however, the option to take surveys conducted by a live telephone interviewer is available to those who do not use the internet as well as those who use the internet but are reluctant to take surveys online.